Understanding the Federal Unemployment Tax Act (FUTA): A Comprehensive Guide for Employers and Employees

"The Federal Unemployment Tax Act is a critical component of our social safety net, helping to protect workers and their families from the devastating effects of unemployment." - Hillary Clinton

Brief Insight

The Federal Unemployment Tax Act (FUTA) is a federal law that imposes a tax on employers to fund unemployment compensation for workers who have lost their jobs. The tax is collected by the Internal Revenue Service (IRS) and the funds are used to provide temporary financial assistance to unemployed workers through state-run unemployment insurance programs.

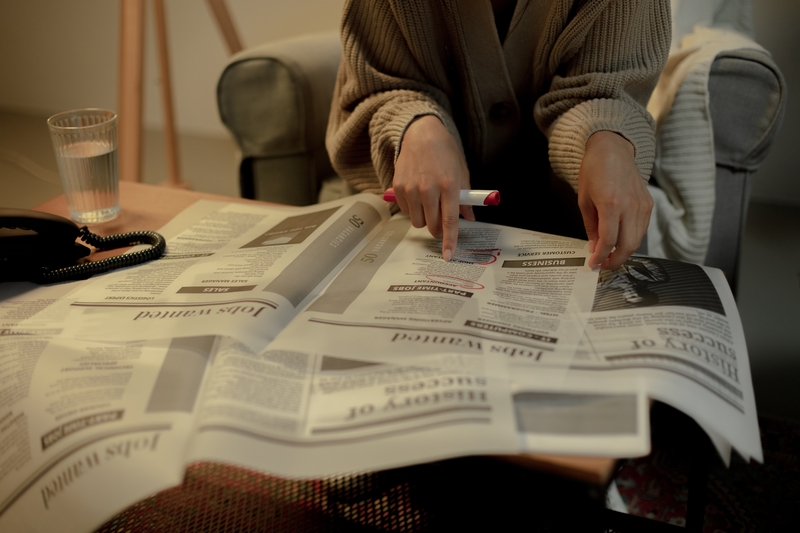

PHOTO: https://www.pexels.com/uk-ua/@mastercowley/

Federal Unemployment Tax Act: A Comprehensive Guide for Employers and Employees

The Federal Unemployment Tax Act (FUTA) is a federal law that was enacted in 1939 to provide temporary financial assistance to workers who have lost their jobs through no fault of their own. FUTA is administered by the Internal Revenue Service (IRS) and imposes a tax on employers to fund state-run unemployment insurance programs.

Under FUTA, employers are required to pay a tax of 6% on the first $7,000 of wages paid to each employee in a calendar year. This tax can be reduced to 0.6% if the employer also pays state unemployment taxes and meets certain other requirements.

The funds collected through FUTA are used to provide temporary financial assistance to unemployed workers through state-run unemployment insurance programs. These programs provide workers with a percentage of their previous wages for a set period of time, typically up to 26 weeks.

To be eligible for unemployment insurance benefits, workers must have lost their job through no fault of their own and meet other eligibility requirements, such as actively seeking work. Employers are required to report wages and pay FUTA taxes quarterly to the IRS, and failure to do so can result in penalties and interest.

The Federal Unemployment Tax Act (FUTA) is a federal law that imposes a tax on employers to fund state-run unemployment insurance programs. The funds collected through FUTA are used to provide temporary financial assistance to unemployed workers who have lost their jobs through no fault of their own.

Interesting Facts

The FUTA tax rate is scheduled to decrease to 0.0% in 2026, but this could change if Congress takes action to extend the tax or adjust the rate.

Employers can file FUTA taxes electronically through the IRS's online e-file system, which can help to reduce errors and processing time.

FUTA benefits are typically paid out on a weekly basis, and the amount of the benefit is based on the individual's past earnings and other factors.

FUTA benefits are subject to federal income tax and may also be subject to state income tax, depending on the individual's state of residence.

The History of the Federal Unemployment Tax Act

The Federal Unemployment Tax Act (FUTA) was created in 1939 as part of the Social Security Act of 1935. The law was designed to provide temporary financial assistance to workers who have lost their jobs through no fault of their own, and to promote economic stability during times of high unemployment.

Before the creation of FUTA, unemployment insurance programs were run at the state level and funded by state taxes. However, during the Great Depression, many states were unable to fund their unemployment programs, and millions of workers were left without assistance.

To address this problem, Congress passed the Social Security Act in 1935, which included provisions for a federal unemployment insurance program. FUTA was created as part of this program to provide funding for state-run unemployment insurance programs.

Under FUTA, employers are required to pay a tax on the first $7,000 of wages paid to each employee in a calendar year. The funds collected through this tax are used to provide temporary financial assistance to unemployed workers through state-run unemployment insurance programs.

Since its creation, FUTA has been amended several times to address changes in the labor market and the economy. For example, during times of high unemployment, Congress has extended the length of time that workers can receive unemployment benefits and provided additional funding for state programs.

The Federal Unemployment Tax Act (FUTA) was created in 1939 as part of the Social Security Act of 1935 to provide temporary financial assistance to workers who have lost their jobs through no fault of their own. FUTA is a critical component of the social safety net and has helped millions of workers during times of economic hardship.

PHOTO: https://www.pexels.com/uk-ua/@sora-shimazaki/

Funding the Federal Unemployment Tax Act (FUTA): A Comprehensive Guide

The Federal Unemployment Tax Act (FUTA) is funded by taxing employers. Under FUTA, employers are required to pay a tax on the first $7,000 of wages paid to each employee in a calendar year. The tax rate is 6%, but employers who also pay state unemployment taxes and meet certain other requirements can have their rate reduced to 0.6%.

The funds collected through FUTA are used to provide temporary financial assistance to unemployed workers through state-run unemployment insurance programs. These programs provide workers with a percentage of their previous wages for a set period of time, typically up to 26 weeks.

The amount of funding provided by FUTA can vary depending on the unemployment rate in each state. When the unemployment rate is low, the amount of funding provided by FUTA may be reduced, while during times of high unemployment, the amount of funding may be increased.

FUTA is administered by the Internal Revenue Service (IRS), and employers are required to report wages and pay FUTA taxes quarterly to the IRS. Failure to do so can result in penalties and interest.

In addition to funding state-run unemployment insurance programs, FUTA also provides funding for a number of other programs related to unemployment. For example, FUTA provides funding for job training programs, job search assistance, and other services designed to help unemployed workers find new employment.

The Federal Unemployment Tax Act (FUTA) is funded through a tax on employers, which is used to provide temporary financial assistance to unemployed workers through state-run unemployment insurance programs. The amount of funding provided by FUTA can vary depending on the unemployment rate in each state, and failure to pay FUTA taxes can result in penalties and interest.

Last Trends

Impact of COVID-19: The COVID-19 pandemic has had a significant impact on unemployment rates and the availability of unemployment insurance benefits, which could lead to changes in FUTA policies or funding.

Technology improvements: The administration of FUTA benefits and taxes may be impacted by advances in technology, such as the use of blockchain or artificial intelligence to improve efficiency and reduce errors.

Administration of the Federal Unemployment Tax Act

The Federal Unemployment Tax Act (FUTA) is administered by the Internal Revenue Service (IRS), which is responsible for collecting FUTA taxes from employers and distributing these funds to state-run unemployment insurance programs.

Under FUTA, employers are required to pay a tax on the first $7,000 of wages paid to each employee in a calendar year. The tax rate is 6%, but employers who also pay state unemployment taxes and meet certain other requirements can have their rate reduced to 0.6%.

Employers are required to report wages and pay FUTA taxes quarterly to the IRS. Failure to do so can result in penalties and interest. The IRS also provides guidance to employers on how to comply with FUTA regulations and offers resources and tools to help employers calculate and report their FUTA taxes.

The funds collected through FUTA are used to provide temporary financial assistance to unemployed workers through state-run unemployment insurance programs. These programs provide workers with a percentage of their previous wages for a set period of time, typically up to 26 weeks. The amount of funding provided by FUTA can vary depending on the unemployment rate in each state.

In addition to funding state-run unemployment insurance programs, FUTA also provides funding for a number of other programs related to unemployment. For example, FUTA provides funding for job training programs, job search assistance, and other services designed to help unemployed workers find new employment.

Overall, the administration of FUTA is critical to ensuring that unemployed workers have access to the financial assistance and support they need during times of economic hardship. The IRS plays a key role in collecting and distributing FUTA funds, and employers must comply with FUTA regulations to avoid penalties and ensure that the funds are distributed to those in need.

The Federal Unemployment Tax Act (FUTA) is administered by the Internal Revenue Service (IRS), which is responsible for collecting FUTA taxes from employers and distributing these funds to state-run unemployment insurance programs. The IRS provides guidance and resources to employers to help them comply with FUTA regulations, and failure to do so can result in penalties and interest. FUTA is critical to providing temporary financial assistance to unemployed workers and supporting job training and job search assistance programs.

PHOTO: https://www.pexels.com/uk-ua/@ron-lach/

Supporting Workers During Times of Economic Hardship

The Federal Unemployment Tax Act (FUTA) provides a range of services to support workers during times of economic hardship, including financial assistance through state-run unemployment insurance programs, job training programs, job search assistance, and other services designed to help workers find new employment.

One of the primary services provided by FUTA is financial assistance through state-run unemployment insurance programs. Workers who have lost their jobs due to reasons beyond their control, such as layoffs or business closures, may be eligible to receive a percentage of their previous wages for a set period of time, typically up to 26 weeks. The amount of financial assistance provided can vary depending on the state and the worker's previous wages.

In addition to financial assistance, FUTA also provides funding for job training programs designed to help unemployed workers acquire new skills and prepare for new job opportunities. These programs may include vocational training, apprenticeships, or other forms of job training. FUTA funding also supports job search assistance programs, which provide workers with resources and support to help them find new employment, such as job fairs, resume writing workshops, and job placement services.

FUTA also provides funding for a range of other programs designed to support workers during times of economic hardship. For example, FUTA funding supports programs that provide financial assistance to workers who have exhausted their unemployment benefits, as well as programs that provide support and resources to workers with disabilities or other barriers to employment.

Overall, the services provided by FUTA are critical to supporting workers during times of economic hardship and helping them get back on their feet. These services provide financial assistance, job training, job search assistance, and other resources to help workers find new employment and improve their economic prospects.

The Federal Unemployment Tax Act (FUTA) provides a range of services to support workers during times of economic hardship, including financial assistance through state-run unemployment insurance programs, job training programs, job search assistance, and other services designed to help workers find new employment. These services are critical to helping workers get back on their feet and improve their economic prospects.

Interesting Facts

FUTA was enacted in 1939 as part of the Social Security Act, which also established the Social Security program.

The original FUTA tax rate was 2.7%, but it has been raised several times over the years to its current rate of 6.0%.

Employers who fail to pay FUTA taxes on time may be subject to penalties and interest charges, and may also lose their eligibility for the FUTA tax credit.

FUTA provides funding for both state and federal unemployment insurance programs, which are designed to provide financial assistance to workers who have lost their jobs through no fault of their own.

Eligibility for Federal Unemployment Tax Act: Understanding Who Can Receive Financial Assistance

The Federal Unemployment Tax Act (FUTA) provides financial assistance to eligible workers who have lost their jobs due to reasons beyond their control. Eligibility for FUTA financial assistance is determined by a range of factors, including work history, the reason for job loss, and state of residence.

To be eligible for FUTA financial assistance, a worker must have lost their job due to reasons beyond their control, such as a layoff, business closure, or reduction in workforce. Workers who voluntarily leave their jobs, or who are terminated for cause, are generally not eligible for FUTA financial assistance.

In addition to the reason for job loss, eligibility for FUTA financial assistance is also determined by work history. To be eligible for FUTA financial assistance, a worker must have worked for a certain period of time and earned a minimum amount of wages during that time. The exact requirements vary by state, but generally, a worker must have worked for at least a year and earned a minimum amount of wages during that time.

Eligibility for FUTA financial assistance is also determined by the state of residence. Each state has its own unemployment insurance program, which is funded in part by FUTA taxes. The eligibility requirements for each state's unemployment insurance program may vary slightly, so it is important for workers to check their state's requirements to determine their eligibility.

Finally, it is important to note that not all workers are eligible for FUTA financial assistance. For example, self-employed workers, independent contractors, and gig economy workers are generally not eligible for FUTA financial assistance, as they are not considered employees under FUTA regulations.

Eligibility for Federal Unemployment Tax Act (FUTA) financial assistance is determined by a range of factors, including work history, the reason for job loss, and state of residence. Workers who have lost their jobs due to reasons beyond their control, and who meet the minimum work history and wage requirements, may be eligible for FUTA financial assistance through their state's unemployment insurance program. It is important for workers to check their state's eligibility requirements to determine their eligibility for FUTA financial assistance.

PHOTO: https://www.pexels.com/uk-ua/@ron-lach/

The Benefits and Advantages of the Federal Unemployment Tax Act

The Federal Unemployment Tax Act (FUTA) provides a range of benefits and advantages to workers and the economy as a whole. These benefits include financial assistance for unemployed workers, support for job training and job search assistance programs, and the stimulation of the economy through increased consumer spending.

One of the primary benefits of FUTA is the financial assistance provided to unemployed workers through state-run unemployment insurance programs. This assistance can help workers pay for basic living expenses such as housing, food, and healthcare while they search for new employment. This assistance not only benefits workers directly, but it can also help to prevent a larger economic downturn by providing a safety net for those who have lost their jobs.

In addition to financial assistance, FUTA provides funding for job training and job search assistance programs. These programs can help unemployed workers acquire new skills and find new job opportunities, improving their economic prospects in the long term. This can also benefit the economy as a whole, as a more skilled workforce can increase productivity and innovation.

Another advantage of FUTA is the stimulation of the economy through increased consumer spending. When unemployed workers receive financial assistance, they are more likely to spend that money on goods and services, thereby stimulating economic activity. This increased economic activity can create new jobs and promote economic growth.

Finally, FUTA provides a stable funding source for state-run unemployment insurance programs. This funding allows states to provide financial assistance to unemployed workers during times of economic hardship, without having to rely solely on state funds.

The Federal Unemployment Tax Act (FUTA) provides a range of benefits and advantages to workers and the economy as a whole. These benefits include financial assistance for unemployed workers, support for job training and job search assistance programs, the stimulation of the economy through increased consumer spending, and stable funding for state-run unemployment insurance programs. FUTA plays a critical role in supporting workers during times of economic hardship and promoting long-term economic growth.

Last Trends

Changes to FUTA tax rates or credits: The federal government may adjust the FUTA tax rates or credits based on changes to the economy or other factors.

State-level unemployment insurance reforms: Many states are considering reforms to their unemployment insurance programs, which could have an impact on FUTA.

Legislative proposals: There may be legislative proposals at the federal or state level that could impact FUTA, such as proposals to expand unemployment insurance benefits or reduce employer taxes.

Examining the Challenges of Unemployment Insurance Programs

While the Federal Unemployment Tax Act (FUTA) provides essential financial assistance to unemployed workers and promotes economic stability, there are also several limitations and disadvantages to the program.

One major limitation of FUTA is that it only provides financial assistance to workers who have lost their jobs due to reasons beyond their control. Workers who voluntarily leave their jobs or who are terminated for cause are generally not eligible for unemployment insurance benefits. This can create challenges for workers who may have left their jobs due to unsafe working conditions, discrimination, or other reasons that were beyond their control.

Another limitation of FUTA is that it provides limited financial assistance to unemployed workers. The amount of financial assistance provided by unemployment insurance programs varies by state, but in many cases, it is not enough to cover basic living expenses. This can create financial hardship for unemployed workers and their families, especially during times of economic downturn.

In addition, the funding for unemployment insurance programs is primarily provided by employers through payroll taxes. This can create challenges for small businesses and businesses in industries with high rates of employee turnover, as they may be required to pay higher taxes to support the program.

Furthermore, FUTA does not provide financial assistance to all workers. Self-employed workers, independent contractors, and gig economy workers are generally not eligible for unemployment insurance benefits, as they are not considered employees under FUTA regulations. This can create challenges for workers who may not have a steady source of income and who may struggle to make ends meet during periods of unemployment.

Finally, the administration of unemployment insurance programs can be complex and bureaucratic, creating challenges for both workers and employers. Workers may struggle to navigate the application process and meet the eligibility requirements, while employers may face challenges in managing their payroll taxes and complying with regulatory requirements.

While the Federal Unemployment Tax Act (FUTA) provides important financial assistance to unemployed workers and promotes economic stability, there are also several limitations and disadvantages to the program. These include limited financial assistance, eligibility requirements that exclude some workers, funding challenges for employers, and administrative complexity. It is important to continue to examine these limitations and work towards improving unemployment insurance programs to better support workers and the economy.

PHOTO: https://www.pexels.com/uk-ua/@ron-lach/

A Step-by-Step Guide to Unemployment Insurance Benefits

Applying for Federal Unemployment Tax Act (FUTA) benefits can be a complex and challenging process, but it is an important resource for workers who have lost their jobs through no fault of their own. Here is a step-by-step guide to help individuals apply for unemployment insurance benefits through FUTA.

- Step 1: Check eligibility requirements - Before applying for FUTA benefits, it is important to ensure that you meet the eligibility requirements. These requirements vary by state, but generally, you must have lost your job through no fault of your own, be actively seeking employment, and have earned a certain amount of income during your base period.

- Step 2: Gather necessary information - To apply for FUTA benefits, you will need to provide personal information, employment history, and income information. This may include your Social Security number, driver’s license, contact information, and employment history for the past 18 months.

- Step 3: File a claim - The next step is to file a claim for unemployment insurance benefits. This can typically be done online through the state’s unemployment insurance website or by phone. Some states may also offer in-person filing options.

- Step 4: Attend an eligibility interview - Once you file a claim, you may be required to attend an eligibility interview to verify your eligibility for benefits. This may be conducted in person or over the phone.

- Step 5: Register for work - To continue receiving FUTA benefits, you may be required to register for work with the state’s employment service. This may involve creating a resume, searching for job openings, and attending job fairs or training programs.

- Step 6: Continue to file weekly claims - To receive weekly unemployment insurance benefits, you must continue to file weekly claims. These claims typically require you to certify that you are actively seeking employment and have not refused any job offers.

In conclusion, applying for Federal Unemployment Tax Act (FUTA) benefits can be a challenging process, but it is an important resource for workers who have lost their jobs through no fault of their own. By following these steps and meeting eligibility requirements, individuals can access financial assistance and support as they search for new employment opportunities.

- The Federal Unemployment Tax Act (FUTA) is a federal law that requires employers to pay taxes into a fund that provides unemployment insurance benefits to eligible workers who have lost their jobs.

- FUTA is funded through a tax on employers, which is used to support state unemployment insurance programs.

- Eligibility for FUTA benefits varies by state but generally requires that the worker lost their job through no fault of their own and is actively seeking new employment opportunities.

- FUTA benefits provide temporary financial assistance to eligible workers while they search for new employment opportunities.

- While FUTA benefits can be a valuable resource for workers, the process of applying for and receiving benefits can be complex and challenging.

- FUTA benefits can help support the economy by stabilizing the income of workers who have lost their jobs and reducing the risk of long-term unemployment.

FAQ

Are all employers required to pay into FUTA?

No, not all employers are required to pay into FUTA. The tax is only levied on employers who meet certain criteria, such as having paid at least $1,500 in wages to employees during any calendar quarter in the current or previous year.

How much is the FUTA tax?

The FUTA tax rate is currently 6.0% of the first $7,000 of wages paid to each employee each year. However, employers who pay state unemployment taxes on time can receive a credit of up to 5.4%, effectively reducing the federal tax rate to 0.6%.

Can self-employed individuals or independent contractors receive FUTA benefits?

No, self-employed individuals and independent contractors are not eligible for FUTA benefits. However, they may be eligible for other forms of financial assistance, such as pandemic unemployment assistance (PUA) provided under the CARES Act.

How are FUTA benefits taxed?

FUTA benefits are considered taxable income and are subject to federal income tax. Some states may also require individuals to pay state income tax on their FUTA benefits.

How long does it take to receive FUTA benefits?

The time it takes to receive FUTA benefits varies by state and can depend on a variety of factors, such as the complexity of the claim and the availability of funds. In some cases, individuals may receive their first payment within a few weeks of filing a claim, while in other cases, it may take several weeks or even months.